You’ll find my writing at:

- Endurance Essentials – endurance & fitness

- True Wealth – finances & family

I hope you join the community

See you there

You’ll find my writing at:

I hope you join the community

See you there

Year-end reviews can focus on stuff & achievements

I’m grateful for my younger self’s relentless focus on buying me time

I’m shifting my writing over to Substack:

I hope you join the community.

Ryan came over and we went deep with a progressive bike test.

You’ll find article, video and training prescription in this morning’s Substack post.

I’m shifting my writing over to Substack:

I hope you join the community.

Getting Faster This Week has published on Endurance Essentials

I’m shifting my writing over to Substack:

I hope you join the community.

New this morning on my Substack

More ideas Monday when I unpack @theryandreyer Lactate Test

👇

https://feelthebyrn.substack.com/p/how-i-ride

I’m shifting my writing over to Substack:

I hope you join the community.

You’ll find today’s post over at my new location on Substack.

Time is a critical component of your endurance training. The article covers the origin of Big Day Training, which was my favorite workout as an elite triathlete. Also covered, is how you can apply the principles for amateur athletes.

An Ultraman Training Day – The Origin of Big Day Training

I’m in the process of moving my endurance writing over to Substack and hope you join the community over there.

I’ve changed the format of the Sunday Summary to something more user friendly

It’s called Getting Faster This Week and you can find it at my Substack

I’m in the process of moving my writing to Substack and hope you join the community over there.

At the start of 2022, a vision came to me:

That’s was my vision.

What is your vision?

That’s for you to decide.

I’m going to show you how to get there.

I’m ahead of schedule and have done it several times before.

If you’re feeling courageous, maybe tell someone.

Absolutely, tell yourself, in writing.

Own it.

Over time, perhaps you realize your fears are an illusion and you share your vision with the world.

What’s it going to take?

So much work, it’s overwhelming.

Inside my light was going out.

It was time for a change.

Asking the right question, the answer arrived.

Positive change is built from new connections and action.

How many new connections do I need?

Seemed do-able. Certainly worth trying.

Break the goal down into simple, manageable pieces then do them, daily.

My best case scenario requires 4 new connections a day. I can do this.

What do I know about action?

What actions can I commit to making happen for 1000 days?

Seems small. Simple is a better way to think of it.

Simple, daily actions.

Fitness takes a long time to accrue. Just the way it is.

Fortunately, the real world is NOT like that.

Everybody gets their shot.

Thing is, we never know which connection will come through.

In 2022, Rich Roll gave me my shot. Our podcast goes SuperNova and brings five years of connection in a fortnight.

Keep swinging.

Our connections let us know what resonates.

In January, I am migrating to Substack and splitting my blog.

WordPress won’t let me migrate you – you’ll need to sign up.

Subscription is free – there’s an option to financially contribute if you wish.

Come along for the ride. It’s going to be great.

Every new cyclist knows the feeling of being completely blown after a hard effort.

In my first bike race, I decided to attack the bunch, downhill. Don’t ask me why. Back then, I’d lose my mind when my HR was up.

The attack left my legs shattered and saw me quickly spat out the back when the bunch rolled me up.

In swimming, as I challenged my ability to swim long via 4000, 5000, 6500 and, eventually, 10000 meter workouts, there would be days when a switch-flipped and, instantly, my pace dropped by 10s per 100.

Like my first bike race, there was no coming back.

In running, particularly long races, my experience was different yet again.

Here, pain would slowly build in in my legs and my pace would gradually slow.

Eventually, my legs would be so beat up, I was unable to place a meaningful load on my cardiovascular system.

Fueled up, and hydrated, with no ability to raise my heart rate.

Exercise physiologists refer to the above as Durability

…the time of onset and magnitude of deterioration of physiological performance parameters over time during prolonged exercise.

– TTS Podcast with ed maunder & stephen Seiler

Quite a mouthful.

I prefer to think in terms of DEPTH.

Think Deep.

Deep Fitness

Fitness, that goes the distance.

Fitness, nurtured with sleep and nutrition.

How might we build this fitness?

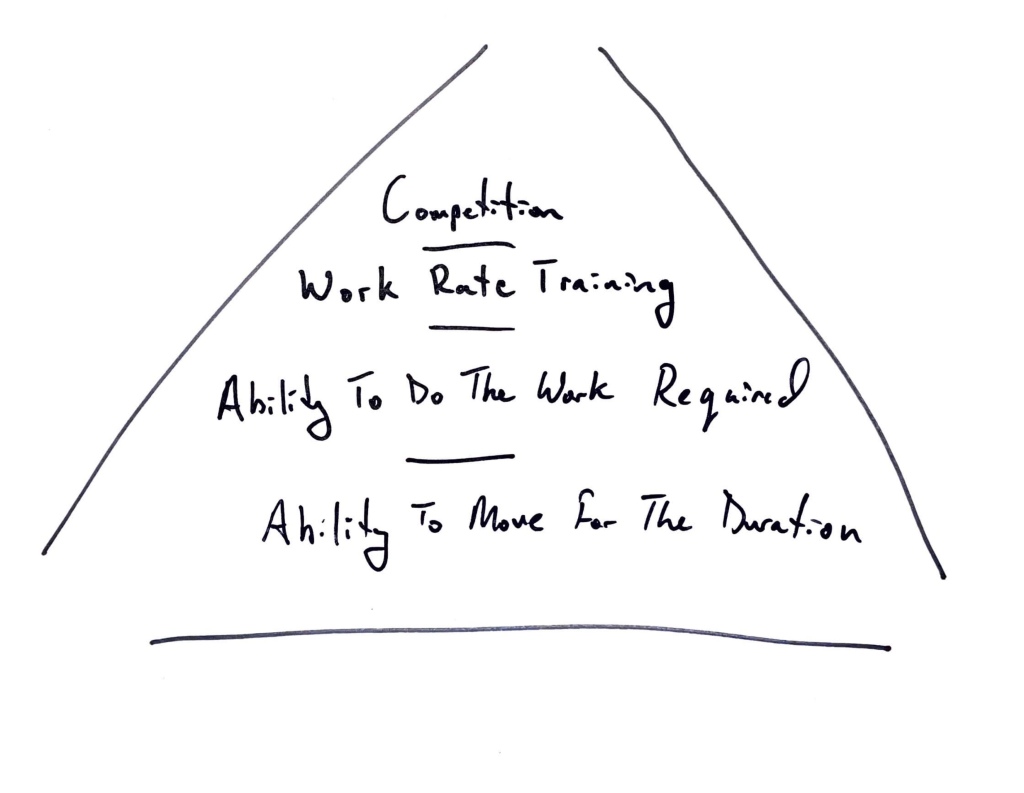

Last Monday, I shared an Endurance Hierarchy

Before you try to get faster, DEEPEN the fitness you already have.

You are going to be surprised by this process.

It will make you faster AND give you the capability to hold your speed.

Dead-simple approach

Make sure you’ve developed the Ability To Do Work before starting this training.

How much should you do? Start with a 90:10 split.

If you incorporate hills then you might already be doing this training without realizing it.

That said, if you are ‘trying’ on your hills then you are likely to be training more intensely than required.

This tip, to slow down, will be a recurring form of my advice to you.

++

You’re almost certainly training more intensely than you realize.

It’s not your fault. It’s the way we’re wired.

The solution is simple, aim your mistakes towards “low & less.”

In the unlikely event you’re aiming too low, you get more volume around aerobic threshold.

This is not a problem, it’s a benefit from my approach.

You’ll benefit in avoiding the common pitfall of nuking yourself as soon as you add a bit of “proper” training.

++

What is a Heavy Domain set?

I’ve written out examples for you.

Tips for all sports:

Advanced athletes, build up to 40-60 minutes worth of work, broken.

Remember: this is not more than 10% of your total volume

Resist: the urge to go bananas when heart rate rises

Know: The big gains come from:

Build fitness that permeates every cell of your body.

Think DEEP

In January, I am migrating to Substack and splitting my blog.

WordPress won’t let me migrate my existing subscribers.

Subscription is free – there’s an option to financially contribute if you wish.

Come along for the ride. It’s going to be great.

Upside Strength with Sean Seale – covered season planning, athletic development, personality profiles of elite athletes, individual variation in training response, recovery tactics… and more.

Top Five Threads

Endurance Training Tips

High Performance Habits

You must be logged in to post a comment.