Between summer day camp and the school year starting mid-August, I’ve had two months of a relatively quiet household.

Between summer day camp and the school year starting mid-August, I’ve had two months of a relatively quiet household.

I used this time to re-read Taleb and Munger. You can find my full notes here.

My initial purpose of re-reading was to figure out “what to do.”

It is far easier to be certain about what NOT to do.

Do you know what can ruin your family’s life?

I do.

- Racing, especially high speed downhill => physical ruin leading to a downward mental spiral.

- Alcohol use => historically, my average daily consumption is either: (a) zero; or (b) slowly trending upwards.

- Anger => if I am going to screw up a key relationship then it will be when I act on anger.

- Death by Accident or Avalanche

What is your list?

Assets and spending do not create a life with meaning.

My true job is keeping our cost of living down so we maintain the ability to control our schedules.

- Be wary of adopting the preferences of others. It’s easy to sign yourself up for millions of lifetime spending that won’t mean a thing to you late in life. Worse yet, you will pass these values to your kids and they blow whatever you leave behind.

- Pay attention when you notice “better” doesn’t make a difference. “Wasn’t worth it” happens to me a lot.

- Pay attention to the cost you pay in time and emotion => it costs me a lot of worry and stress to get more money. Way easier to spend less.

- Once you are beholden to a third-party, you’ve lost.

- A lot of times “worse isn’t worse.” We adapt very quickly to setbacks.

We discuss case studies at home. Housing, vacations, cars, the endless “needs” my kids and I dream up.

So while I’m removing things that can ruin me, and beating down my hedonistic tendencies… What to do?

Wait for the fat pitch.

A key benefit of a good position is being able to wait until the credit cycle swings in your favor.

The longer we have to wait, the better the opportunities. Cutting rates, running trillion-dollar deficits at the top of the economic cycle… there will be great deals eventually.

I’m not excited about any asset class right now.

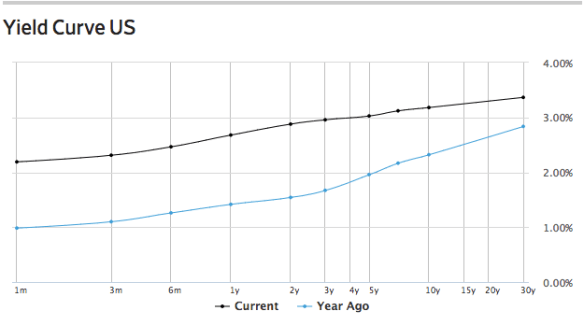

- The bond market is telling me that we’ve pulled 5-10 years of returns forward.

- Net yields are under 1% for real estate that I’d like to buy.

- The rest of my balance sheet feels like “enough” exposure.

I’ve decided to make no material new investments. We are going to periodically rebalance and I am going to reduce my cost of living.

What to do?

Enjoy nature with my family and pass my value system to my kids (by living the life I wish for them).

The benefit of creating a good position is you can choose not to leave it.

The benefit of creating a good position is you can choose not to leave it. A quick review, I calculate financial wealth as:

A quick review, I calculate financial wealth as:

The Elephant(s) in The Room

The Elephant(s) in The Room

This one sat on my shelf for a while

This one sat on my shelf for a while It is much easier to position your life before, rather than during, an economic crisis.

It is much easier to position your life before, rather than during, an economic crisis.

You must be logged in to post a comment.