When I think about success, I experience the human quirk of self-attribution bias.

In other words, I believe that my failures are due to external circumstances (those damn flat tires) and success is due to my own efforts (my life today).

In athletics, I played the game of Ironman Triathlon (swim 2.4 miles, bike 112 miles and run 26.2 miles). Two observations about the game, at the time I played it:

- Very few people were willing to subject themselves to “proper” training

- Most winning times (today, any venue) would have been world-records when I raced

Two ideas flow from these observations.

First, if “winning” is important then find a narrow niche where you enjoy working your a$$ off.

Second, in a field where not many people are willing to do-what-it-takes, be cautious with your self-assessment.

World class is a lot easier when you’re not competing against the world!

I was able to play triathlon, because I spent a decade playing Private Equity, in Europe and in Asia.

The only way you can lose this game is by going bust:

- Gather money every five years => each fundraising created a stand-alone “fund”

- Split each fund into a dozen deals, invested over 3-5 years

- Use borrowed money as well as equity

- Wait 4-6 years then sell the deals and keep 20% of the profits

What makes this game interesting is the “house” received an annual commission (2% of equity).

Over the last fifty years the sector went from ZERO to over $500,000,000,000 annual volume => generating a lot of fee income and creating a buyer’s circle where your competition bid up the assets you already own.

If you think you missed out because you weren’t in finance then you might be mistaken. Similar dynamics have been in play in your real estate market (and sectors touched by venture capital).

From 1980 onwards, rapidly increasing assets under management wasn’t the only tail wind.

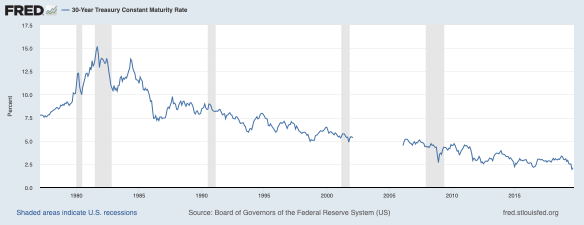

There was the long term debt cycle (10-year treasury rate from 1/1/1979).

Chart looks similar if you use 30-year treasury rate…

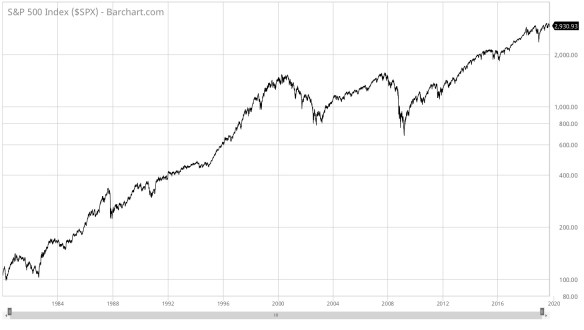

…the debt cycle fed into the stock market (y-axis log scale, SP500 from 1/1/1979).

I started high school (37 years ago) in the bottom left-hand corner of the stock chart. Is it any wonder that I expect things to always work out?

It is human nature to associate my effort with my results. Some will say this association is obvious!

I am not sure. I know that I ignore external factors and hidden evidence:

- of people who worked hard and didn’t succeed

- of crooks and bozos that have done very well

My mantra, “Let’s be careful and remember we are far less talented than we think we are.”

Between summer day camp and the school year starting mid-August, I’ve had two months of a relatively quiet household.

Between summer day camp and the school year starting mid-August, I’ve had two months of a relatively quiet household. The benefit of creating a good position is you can choose not to leave it.

The benefit of creating a good position is you can choose not to leave it. A quick review, I calculate financial wealth as:

A quick review, I calculate financial wealth as:

The Elephant(s) in The Room

The Elephant(s) in The Room The Algebra of Happiness

The Algebra of Happiness I’ve been offline for a bit.

I’ve been offline for a bit.

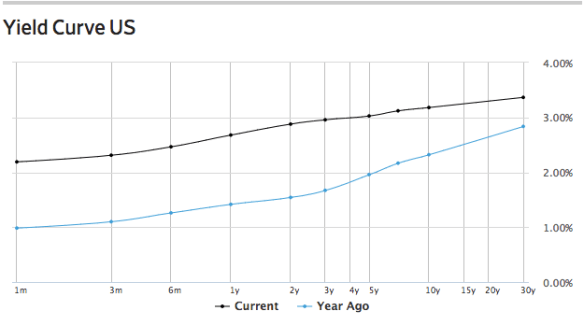

Late-cycle is when we tend to make unforced errors in our financial life. My spidey-senses have been tingling due to a series of macro-events that I’ve noticed.

Late-cycle is when we tend to make unforced errors in our financial life. My spidey-senses have been tingling due to a series of macro-events that I’ve noticed.

You must be logged in to post a comment.